Statement of Responsible Investment

The Trust believes it has a responsibility to consider, in the context of its investment decisions, the negative and positive effects on society and the environment resulting from decisions made by the companies, institutions, and governments in which it invests. In particular:

- Human rights and wellbeing.

- Labour standards.

- The environment and climate change.

- Bribery and corruption.

- Appropriate governance structures and processes.

- Sustainability.

The Trust may invest in products which are specifically designed to meet the Trust’s responsible investment goals. The Trust requires its fund managers to consider environmental, social and governance matters in relation to all investment decisions. When selecting and monitoring fund managers, the Trust will seek information about the capacity and practices of potential fund managers to consider environmental, social and governance matters in investment decisions.

The Trust may contract with an appropriate company that has the expertise and weight to provide an engagement overlay on the Trust’s behalf in respect of one or more of its asset classes. Such an overlay will include responsible, sustained and constructive dialogue with companies that fall short of appropriate, internationally recognised standards, benchmarks and expectations, as well as the judicious and transparent use of the Trust’s share of voting rights in pooled asset classes.

The Trust is a signatory to the Principles for Responsible Investment (PRI) and participates in the Small and Resource Constrained Funds Initiative coordinated by the Secretariat. The commitment to PRI means the Trust aims to meet, over time, each of the six principles and to report on its progress in relation to the principles. The preamble and principles are set out below:

As institutional investors, we have a duty to act in the best long-term interests of our beneficiaries. In this fiduciary role, we believe that environmental, social, and corporate governance (ESG) issues can affect the performance of investment portfolios (to varying degrees across companies, sectors, regions, asset classes and through time). We also recognise that applying these principles may better align investors with broader objectives of society. Therefore, where consistent with our fiduciary responsibilities, we commit to the following:

Principle 1:

We will incorporate ESG issues into investment analysis and decision-making processes.

Principle 2:

We will be active owners and incorporate ESG issues into our ownership policies and practices.

Principle 3:

We will seek appropriate disclosure on ESG issues by the entities in which we invest.

Principle 4:

We will promote acceptance and implementation of the Principles within the investment industry.

Principle 5:

We will work together to enhance our effectiveness in implementing the Principles.

Principle 6:

We will each report on our activities and progress towards implementing the Principles.

As an asset owner signatory of the PRI, the Trust is eligible to cast an organisational vote to elect representatives to the PRI Board. Participation in any voting process is determined by the chairperson and chief executive.

Investment Exclusions

Exclusions, also referred to as negative screening, is applying filters to lists of potential investments to rule companies out of contention for investment, based on an investor’s preferences, values or ethics.

Consistent with the Trust Waikato investment objective and fiduciary responsibility, the Trust aims to exclude investments that are known to do substantial and irreparable harm to society or the environment.

Trust Waikato prefers engagement as the best way of getting companies to improve their behaviour, rather than exclusion. The Trust excludes companies and sectors where ESG risks cannot be substantially mitigated.

The exclusions are based on New Zealand government law, international treaties, social implications, and the Principles of Responsible Investment.

Trust Waikato sets a threshold exclusion in the investment management agreement for funds with segregated mandates. Trust Waikato recognises that for pooled funds, the exclusions may not be fully applied due to potential indirect exposure to excluded companies. Where applicable, the Trust may share its Statement of Responsible Investment and exclusions with its investment managers to influence their ESG consideration.

The Trust excludes any company having more than 20% of its revenues derived from one or a number of the sectors listed in the table below.

| Exclusion | Rationale |

|---|---|

| Armaments | Social impact Cluster Munitions Convention signed by the New Zealand Government in 2008 |

| Gambling | Social impact |

| Liquor | Social impact |

| Tobacco | Social impact WHO Framework Convention on Tobacco Control 2005 The Smoke-free Environments Act 1990 |

| Pornography | Social Impact The Child Pornography Prevention Act 1996 |

| Fossil fuel extraction | Environment Impact The Paris Agreement Convention on Climate Change The Climate Change Response Amendment Act 2019 |

The Trust may see seek assistance from its investment adviser to monitor the Trust’s exposure to exclusions.

The Trust may review its exclusions from time to time, and significant changes are to be communicated in a timely way to the relevant fund managers. Amendments adopted become mandatory for new investments.

Climate Change Commitment

Trust Waikato acknowledges that human-induced climate change poses a serious and immediate risk to our communities, and that urgent action is required to avoid catastrophic effects for our people and environment.

We believe we have a role to play in mitigating the most severe impacts of climate change, and that we need to work together to develop a resilient community response in order to ensure true kaitiakitanga (guardianship) of our resources for future generations. The effects of climate change will not be felt equally amongst our community and we need to mitigate the inequality of these impacts.

Trust Waikato is committed to becoming a climate leader, to enable a low-emissions future. This will be done by actioning our climate change framework by evaluating the impacts of Trust Waikato’s investments we will reduce the climate change emissions of the Trust’s investment portfolios.

The Paris Aligned Investment Initiative is a collaborative investor-led global forum enabling investors to align their portfolios and activities to the goals of the Paris Agreement.

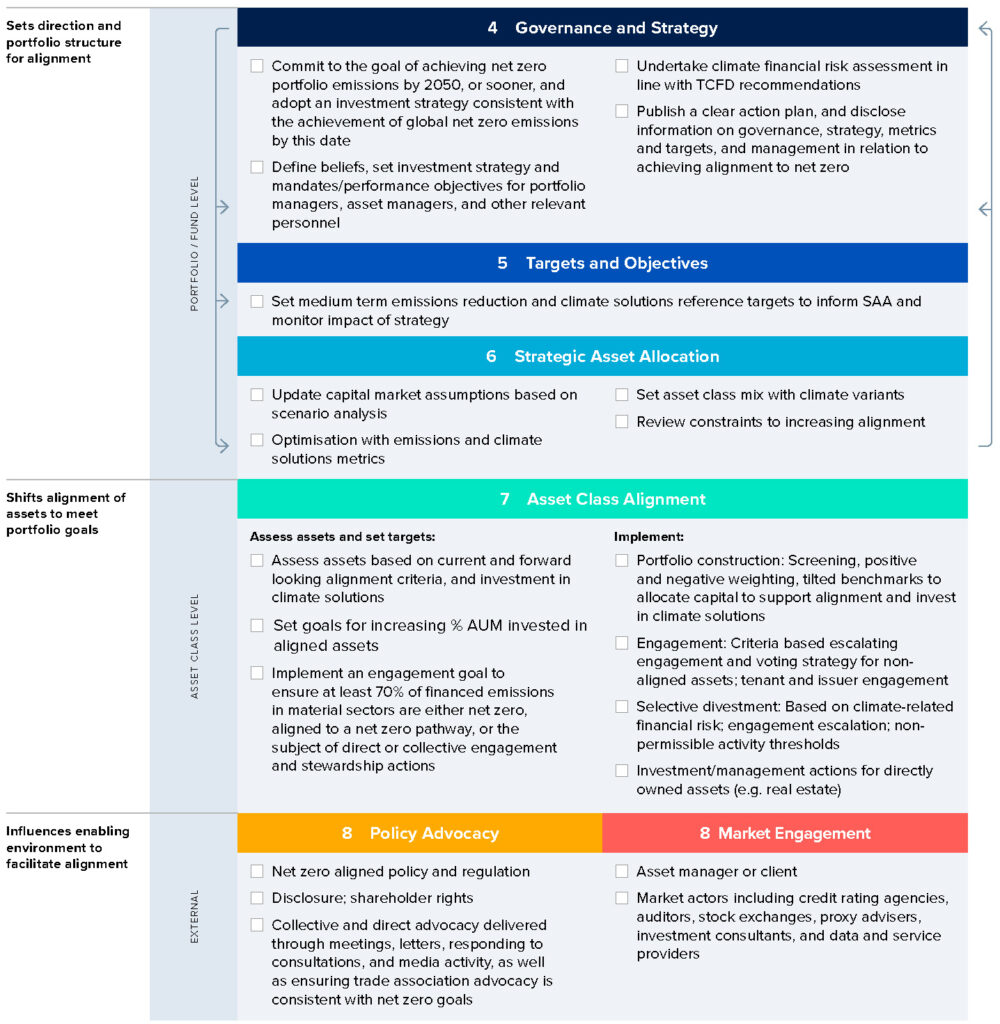

Trust Waikato adopted the Paris Aligned Investment Initiative Net Zero Investment Framework 1.0 to develop an investment strategy to decarbonise investment portfolios in a way that is consistent with achieving global net zero greenhouse gas emissions by 2050.

Trust Waikato agreed to the Paris Aligned Investment Initiative Net Zero Asset Owners Commitment to align portfolios and activities with the Paris Agreement to limit global warming by 1.5ºC. Through the commitment, the Trust pledges to decarbonise its investment portfolio by 2050 or sooner, increase investment in climate solutions, set interim targets and undertake advocacy and engagement in line with net zero goals.

Trust Waikato is a signatory to Climate Action Aotearoa – The Funders Commitment on Climate Action, with the aim to accelerate effective responses to climate change to ensure that everyone has access to opportunities arising from the transition to a low carbon economy.

The Trust is committed to take action to minimise the carbon footprint of our own operations. We will proactively address the risks and opportunities of the transition to a low carbon society in our investment strategies.

The Trust may seek assistance from its investment adviser to incorporate climate change into the Trust investment strategy, asset allocation review, responsible investment framework, and investment recommendations where applicable.

The Trust investment adviser, JANA, reviews the investment objective and strategic asset allocation with trustees annually. Climate change is incorporated in the annual review process to ensure the Trust investment strategy follows the net zero commitment.

The Trust will work with its investment adviser to implement the Paris Aligned Net Zero Investment Framework 1.0 as outlined in the diagram below and report to the Board on the progress:

The Trust established its Responsible Investment (RI) Framework in February 2020 as a guideline for RI implementation, monitoring, and review.

The RI Framework outlines a ‘Six Pillars’ approach to assess the purpose, policies, process, people, products and portfolio of each investment fund and its manager.

The Trust will incorporate climate change commitment impacts within the RI framework. The progress on portfolio decarbonisation will form part of the periodic RI update to the Board.