Our Investments

Key figures

value of the Trust funds

as at 31 March 2024

grants approved for funding

since inception in 1989

Investment Framework

The Trust believes it has a responsibility to consider, in the context of its investment decisions, the negative and positive effects on society and the environment resulting from decisions made by the companies, institutions, and governments in which it invests.

Trust Waikato’s investment strategies are set to preserve the Trust capital, generate income, and invest for impact to achieve the Trust’s mission of investing wisely. Established in perpetuity, the Trust invests for the long term, to not only meet the needs of their communities today, but also to ensure support for future generations.

Target Strategic Asset Allocation as of 31 March 2024

-

23% Global Equities

-

15% Infrastructure

-

15% Property

-

7.5% Australasian Equities

-

7.5% Global Credit

-

5% NZ Private Equity

-

2.5% Impact Investment

-

12% Global Fixed Interest

-

7.5% NZ Fixed Interest

-

5% Cash

Our commitments and engagements

-

Trust Waikato was a founding signatory of Climate Action Aotearoa – The Funders Commitment on Climate Action, launched in 2021 with the aim to accelerate effective responses to climate change to ensure that everyone has access to opportunities arising from the transition to a low carbon economy.

The seven-part commitment is guided by Te Tiriti o Waitangi and maataurangi Maaori aspirations. It focuses on a just transition, collaboration, and leadership. The commitment also calls for decarbonsation of investments and operations. Significantly, it includes reporting back to our communities and stakeholders the actions that signatories undertake.

In 2022, Climate Action Aotearoa launched a ‘Shared Resource’ and Tika Transition framework to help funders along their climate action journeys. The resource provides guidance towards a just, equitable and tika transition that reflects our unique Aotearoa context in key aspects of philanthropy: governance, strategy, investment, grantmaking and operations.

Trust Waikato staff also sit on the Climate Action Working Group who initiated and oversee Climate Action Aotearoa.

-

The Paris Aligned Investment Initiative was launched by the Institutional Investors Group on Climate Change (IIGCC) in Europe in May 2019, to explore how investors can align their portfolios with the goals of the Paris Agreement. In 2021, the Trust adopted the Paris Aligned Investment Initiative Net Zero Investment Framework (PAII) and agreed to the Paris Aligned Investment Initiative Net Zero Asset Owners Commitment to support a net zero and resilient future, transitioning our investments to achieve net zero portfolio greenhouse gas emissions by 2050, or sooner.

-

As a member of Responsible Investment Association Australasia, trustees and staff of Trust Waikato attend the Responsible Investment (RI) conference every year, participating in RI discussions and have hosted Impact Investment events.

Trust Waikato was recognised as one of 16 Responsible Investment Leaders by RIAA in its landmark annual study from October 2023. These investors were applauded for demonstrating leading practice in our commitment to responsible investing; our explicit consideration of environmental, social and governance factors in investment decision making; our strong and collaborative stewardship; and our transparency in reporting activity, including the societal and environmental outcomes being achieved.

RIAA’s Benchmark Report is the most comprehensive review of the responsible investment sector in New Zealand, with the 2023 report reviewing the investment practices of 70 investment managers.

-

Trust Waikato became the 20th signatory for the Stewardship Code Aotearoa New Zealand in 2023. The Stewardship Code’s ESG and Te Ao Maaori worldview principles strongly align with our commitment to sustainability and responsible investment intention.

The Stewardship Code Aotearoa is a set of guiding principles for sustainable investment stewardship and provides a principles-based framework for achieving the goals of effective stewardship. These goals are to create and preserve long-term value for current and future generations; deliver capital efficiency whilst serving the best interests of clients and beneficiaries; and to ensure sustainable outcomes for our environment, society, and economy.

This commitment challenges Trust Waikato to apply best practice in our investment strategy, governance practices and support sustainable outcomes for our environment, society, and economy.

-

The Trust has been a signatory to the United Nations Principles for Responsible Investment (PRI) since 2007. The PRI stands for responsible, sustainable and prosperous, which closely aligns with the Trust’s mission to invest wisely, and its vision of vibrant and resilient Waikato communities.

PRI is the world’s leading proponent of responsible investment. These Principles focus investment risk assessment and decisions through an Environmental, Social and Governance (ESG) lens. The commitment to PRI means the Trust aims to meet, over time, each of the six principles and to report on its progress in relation to the principles as outlined within our Statement of Responsible Investment.

Each year, Trust Waikato reports its responsible investment activities by responding to asset-specific modules in the reporting framework. PRI assesses each module and presents them in a summary scorecard in the assessment. Our efforts to promote responsible investing have been recognised by PRI, which placed us in an international leaders’ group of just 47 members in 2019, for demonstrating responsible investment excellence.

Trust Waikato staff worked with PRI and is a named contributor to a set of tools to help asset owners incorporate ESG factors and considerations into each stage of the selection, appointment and monitoring of asset managers.

Te Puna Hapori

The Te Puna Hapori (meaning “spring of wellbeing”) Community Infrastructure impact investment fund aims to deliver safe and healthy communities for individuals and families to build a home, be educated, grow and flourish.

The fund, which launched in late 2019 catalysed by a partnership between Trust Waikato and Brightlight, galvanises capital to unlock potential and transform lives in underserved communities in New Zealand.

Te Puna Hapori is the first impact debt fund of its type in New Zealand, and a ground-breaking opportunity for progressive investors to effect community-level change while maintaining market-rate returns.

Reports and Resources

Community-Centered Blended Finance

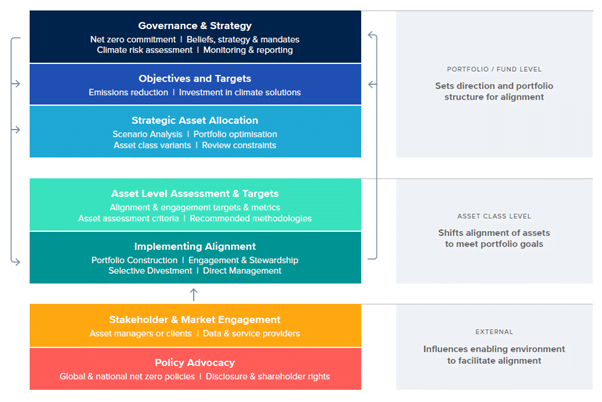

PAII Investment Framework Implementation Guide

PRI Investment Manager Selection Guide

PRI Investment Manager Appointment Guide

PRI Investment Manager Monitoring Guide